May 1, 2020

Updates to US Small Business Aid During COVID-19

Tags:

Updates to US Small Business Aid During COVID-19

May 1, 2020

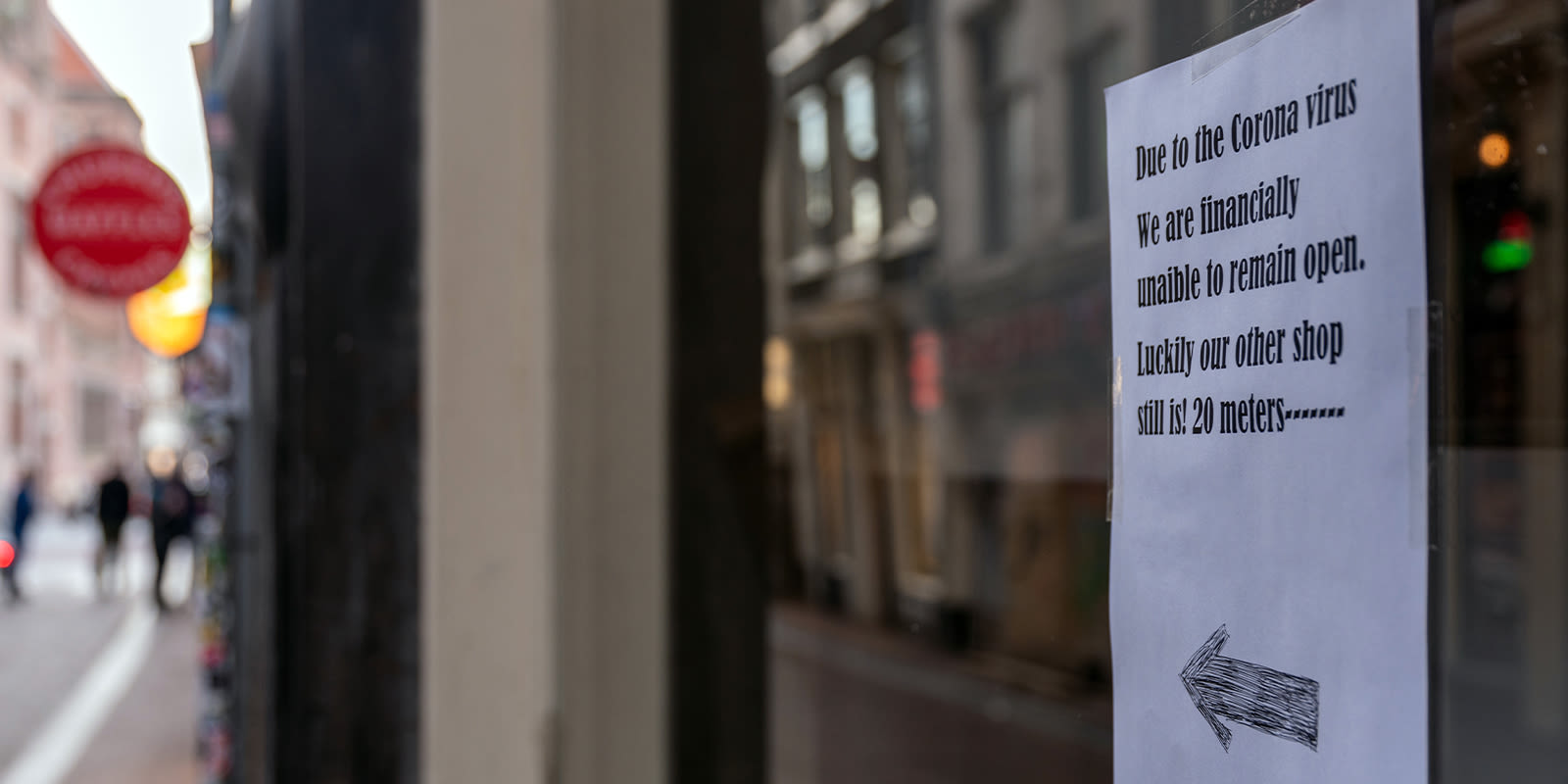

Over the past two months, many US small businesses have fallen off a cliff, as rates of COVID-19 swell around the world, shuttering states and weakening outlooks.

Employing nearly half of the US private sector across all states, and including more than 280,000 small business exporters—plus a broad array of others that import goods, parts, or raw materials—these businesses have a massive impact on the economy. In response, the US federal government has stepped forward with additional support, on the heels of earlier relief efforts.

US Economic Response

Initial small business relief programs ran out of funds quickly and left many confused. In March, lawmakers passed the $2 trillion CARES Act, an economic stimulus bill of sweeping historic proportions. CARES included $377 billion in small business relief, most of which was gone within weeks.

Now, the US House of Representatives has passed an additional $484 billion bill to help small businesses and hospitals, including replenishment of the Paycheck Protection Program, which was exhausted on April 16.

Below are some of the key updates that were recently announced.

Paycheck Protection Program

The Paycheck Protection Program (PPP) resumed acceptance of applications last Monday after initially being depleted. Companies can now borrow up to $10 million to cover eight weeks of payroll.

- While technically this program is a loan, total loan forgiveness is possible if businesses use funds for payroll costs and interest on mortgages, rent, and utilities.

- Since this fund is in high demand, forgiveness requires at least 75% of the forgiven amount to be used for payroll.

- If a business has already laid off employees, it can still qualify by hiring them back.

- If not eligible for forgiveness, the loan has a maturity of two years and an interest rate of 1%.

The program is available through certain institutions, like banks, credit unions, and other regulated lenders. To prevent larger businesses from quickly accessing the money via tight ties to big banks, as happened before, the replenishment sets aside $60 billion for medium, small, and community lenders.

Businesses should be sure to ask institutions about their readiness to process applications and distribute funds under high demand. Many are already inundated with applications from the first round of PPP, and some of these applications may be first in line for new funds.

Get started with the Paycheck Protection Program.

Economic Injury Disaster Loans

Economic Injury Disaster Loans have been around for a while, offering low-interest loans to businesses that have suffered losses after a disaster. These loans are made directly through the Small Business Administration. To apply, visit the SBA website. Be aware that they are pausing temporarily due to the overwhelming amount of requests, but will be accepting applications again soon.

The program also makes an allowance for an Economic Injury Disaster Loan Advance of up to $10,000, which does not need to be repaid. Under CARES, the advance is available to any qualified applicants, whether approved for the loan or not. But, restrictions, like the number of pre-COVID employees, limit loan eligibility.

Businesses that have already applied for the Loan or Loan Advance funding can expect their applications to be processed on a first-come, first-served basis as the fund replenishes.

Learn more about Economic Injury Disaster Loans.

SBA Debt Relief

Small businesses that have obtained 7(a), 504, and Microloans are not required to make payments of principal, interest, or fees for six months, as long as loans are current and in regular servicing status. For loans in deferment, SBA will cover the payments after the deferment period. This deferment is not applicable to PPP or Economic Injury loans. No action is required on the part of borrowers.

A small business that doesn’t qualify for PPP or Economic Injury could still apply for a traditional SBA loan, although processing times are likely to be longer than usual. Since the debt relief program applies to new loans, this strategy may aid those businesses left out of other programs due to business size or structure.

Learn more about SBA debt relief.

Additional Resources

In addition to federally funded programs, many states and even cities are offering their own relief funds or other assistance. For example, California is providing disaster loans of up to $1 million or much smaller loans for $500 to $10,000 for struggling or new entrepreneurs. Meanwhile, the NYC comptroller has vetted a list of private loans for small businesses.

Learn more about how the pandemic is impacting global supply chains, and how you can shore up your business, by visiting the Flexport COVID-19 insights page.

About the Author

May 1, 2020