March 20, 2020

COVID-19: China Trade Recovery Index—March 20

Tags:

COVID-19: China Trade Recovery Index—March 20

As China Appears to Be Recovering from Coronavirus, Trade Is Slowly Coming Back Online

Earlier this week, China reported its first major economic numbers for January and February, and they were dramatically worse than expectations. Not only did the novel Coronavirus take a heavy human toll, it also seriously impeded economic activity in China. With China’s critical role in global supply chains, there has been intense interest in the pace of its recovery. In our earlier report, we questioned whether revival would come fast enough to head off financial distress. This week, we update the data to track the status of COVID-19’s economic impact.

Flexport’s COVID-19 China Trade Recovery Index provides a preliminary look at the air and ocean shipments of its customers, originating in China and being sent to the rest of the world. It measures not the correlates of supply chain activity, but the ultimate result of that activity—shipped products. Based on data through Tuesday, March 10, the recovery that we started to see a week ago remains partial and is proceeding slowly.

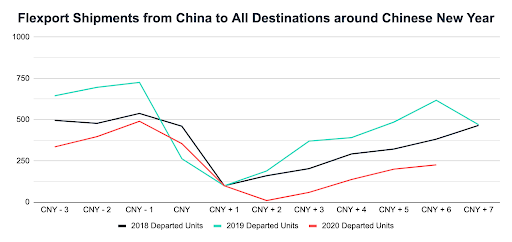

The index measures shipments relative to the normal low point of the week after Chinese New Year (CNY). In the chart above, the shipment volume at that date (CNY+1) is normalized to equal 100 and shipments for 2018 and 2019 are offered for comparison. Shipments a week ago (index value 201 in week CNY+5) had just doubled over the CNY+1 level; this week there was modest growth (index value 229 in week CNY+6). That trending contrasts with the volume of the two previous years.

Despite reassuring signs of recent factory reopening and worker return, the increased economic activity has not kept pace with traditional production increases.

Businesses should be aware that a reliance on airfreight could become increasingly challenging as capacity drops, due to the cancellation of passenger flights. That would likely lead to continued high prices for shipping by air.

For more on the impact of COVID-19, visit our special resources page. And, to learn more about capacity and carrier increases or decreases, check our weekly Freight Market Update.

About the Author