August 9, 2023

A Peek At Peak Season 2023: Will Demand Peak, Or Will It Be Peak Supply?

Tags:

A Peek At Peak Season 2023: Will Demand Peak, Or Will It Be Peak Supply?

There’s a wildcard floating around in the run-up to peak season 2023—new ocean capacity in the form of nearly two and a half million new twenty-foot equivalent units (TEUs) expected to be delivered into the global market before the end of the year. For scale, the entire global market for TEUs shipped (regardless of port pair) is approximately 200 million. Given that a single ship may make four or five roundtrips a year (total global vessel capacity is about 25 million TEU), that’s a substantial influx of vessel capacity.

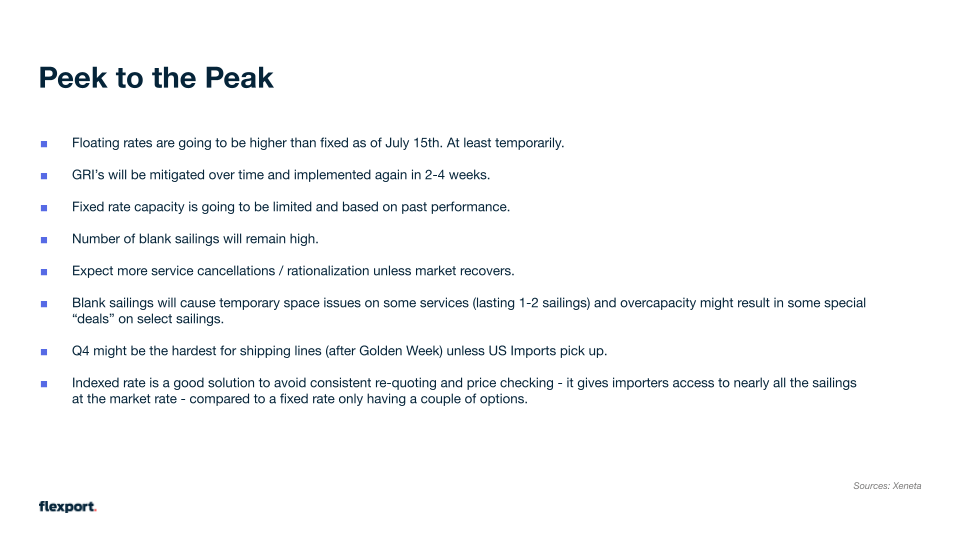

That means carriers will have to act to reduce available capacity, whether by reducing vessel speeds, blanking sailings, canceling services, or extending loops. Even if they do take these measures, overcapacity one week may still lead to a series of small, vessel-sized peaks over the following weeks.

For example, say a carrier sees a 5000 TEU demand for Ho Chi Minh to Los Angeles, but the available vessel size is 9000 TEU. They would likely implement a blank sailing, leading to 10,000 TEU potentially being ready to ship in 2 weeks. Since the vessel is only 9,000 TEU, this situation creates a temporary bottleneck in the form of a mini peak season while they work through that backlog. This is a very simplified example of the pattern I see extending into the new year as even more capacity is due to come on line in the first half of 2024.

A Peek At Peak Season: Volatility On All Fronts

At the heart of this emerging pattern of mini-peaks is market volatility on a micro scale.

Rates

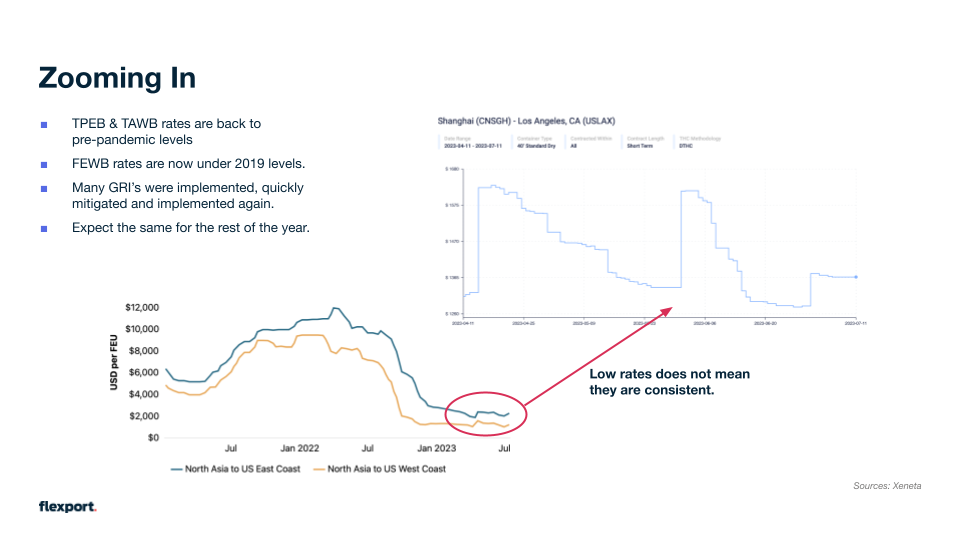

Through the first half of this year, many carriers implemented General Rate Increases (GRIs) to try to stabilize the market, but GRIs tend to have an inverse effect over time. Meaning that within weeks of a GRI going into effect, rates have dropped a bit yet generally remain higher than pre-GRI. Then they drop again in another week, and before long they’re right back where they started (as shown in the graph on the right in the above image).

That means prices aren’t as stable as they look at first, since each rise comes with a corresponding dip when you look closer. It becomes difficult for importers to compare apples to apples, because rates from one party may be quoted pre-GRI and may still be subject to that increase—and from another, post-GRI—so there’s not actually much stability. The takeaway is that low rates do not equal stable rates and this cycle will most likely be with us for the remainder of the year.

Note: A small exception is going to be August through September when a slightly stronger peak is expected and more GRI’s sticking for slightly longer than for ex. June-July.

Supply

As we move deeper into Q3 and the beginning of Q4, the situation with capacity supply is likely to get complicated. The weeks immediately after Golden Week (Oct. 1-7 this year) are generally a shoulder season, with dropping demand. However with the additional capacity I discussed in the introduction entering the market, carriers will most likely add more blanking sailings in an effort to break even on the supply vs demand equation. And with even more additional capacity coming online through Q4 and into 2024, that situation may continue into the foreseeable future.

Demand

As far as demand this peak season—not to sound vague—it truly is anybody’s guess. Between the supply situation outlined above, remaining inventory overages from last year, and the fickle nature of consumer buying habits as demonstrated through the first half of this year, there are more questions than answers at this point.

That doesn’t mean there aren’t steps you can take to ensure you have a smooth transition through peak season and into the holidays. For example, let’s say you have a project shipment coming up in mid-August, something in the 20-50 container size range. Start working with your account manager now to see whether it makes the most sense to book a premium service to ensure transit sooner, or maybe to wait a bit for spot rates to drop after one of those mini peak/blank sailing cycles.

The primary question you need to ask yourself is whether you want to go for overall stability, or if you’re OK playing the rate volatility game to potentially get a better deal on the spot market. If the former, stick with contract rates (if you have them locked in, you avoid the volatility). If the latter, try following indexed rates, since spot rates will likely be fluctuating with the peaks and troughs discussed above you may be able find the deals you’re looking for. Understand, however, that you may also be saddled with spot rates higher than contract when the market swings in that direction.

Traditional ocean freight peak season is approaching. What remains to be seen is how traditional it will turn out to be. Will there be a single peak followed by a single return to normal, as in pre-pandemic years? Or will there be a series of smaller peaks and troughs triggered by new capacity coming online combined with the general consumer swing toward paying more for services than goods this year?

For more context on this and other trends in the global supply chain, watch the July Freight Market Live Webinar, or tune in for the next installment, coming up on August 10th. For other questions, please reach out to our team of experts, they’re always ready to answer your questions, whether related to peak season ‘23 or any other aspect of your business’s supply chain needs.

Disclaimer:

The contents of this blog are made available for informational purposes only and should not be relied upon for any legal, business, or financial decisions. We do not guarantee, represent, or warrant the accuracy or reliability of any of the contents of this blog because they are based on our current beliefs, expectations and assumptions, about which there can be no assurance due to various anticipated and unanticipated events that may occur. This blog has been prepared to the best of our knowledge and research, however the information presented herein may not reflect the most current regulatory or industry developments. Neither Flexport nor its advisors or affiliates shall be liable for any losses that arise in any way due to the reliance on the contents contained in this blog.

All data in images courtesy of Xeneta